Graphics by AJP Song Ji-yoon

Graphics by AJP Song Ji-yoon SEOUL, November 04 (AJP) - Asian stocks fell across the board Tuesday as profit-taking swept through the region, with South Korea’s KOSPI posting the steepest loss among major Asian benchmarks and Japan’s Nikkei 225 also tumbling sharply.

South Korea’s KOSPI slid 2.37 percent to close at 4,121.74, wiping out the previous day’s gains. Foreign investors dumped 2.2 trillion won ($1.5 billion) worth of shares, joined by institutional investors who offloaded 498.6 billion won. Individual investors, however, stepped in aggressively, net buying 2.6 trillion won as they searched for bargains in a market that recently enjoyed historic momentum.

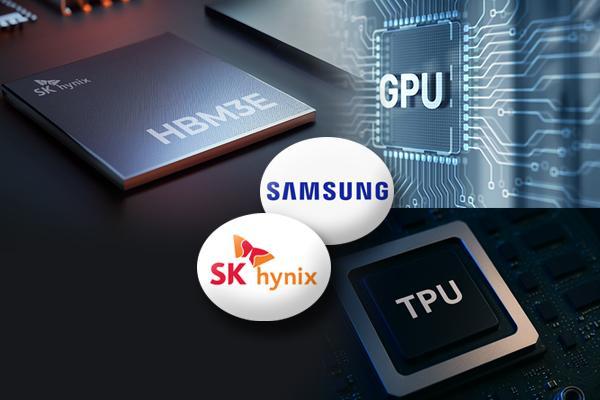

Chip heavyweights that had powered recent rallies on strong earnings and the so-called “Jensen Huang effect” reversed sharply. Samsung Electronics sank 5.58 percent to 104,900 won, while SK hynix fell 5 percent to 589,000 won. Both had surged in recent weeks on record quarterly results and NVIDIA CEO Jensen Huang’s high-profile visit to Seoul, but succumbed to heavy profit-taking.

SK hynix’s pullback was further intensified after the Korea Exchange designated the stock as an “investment alert,” citing excessive use of margin accounts following its more than 10 percent jump the previous session.

Defense stocks that had soared on blockbuster earnings also retreated. Hanwha Aerospace slipped 3.07 percent to 1,010,000 won, while Hyundai Rotem fell 5.93 percent to 230,000 won.

By contrast, copper and cable shares rallied after Microsoft CEO Satya Nadella warned in a podcast that “the AI industry will face bottlenecks if power supply issues are not resolved.” Taihan Cable surged 7.75 percent to 27,100 won, and LS, the parent of LS Cable, gained 2.3 percent to 222,500 won.

The tech-heavy KOSDAQ bucked the broader decline, rising 1.31 percent to 926.57, led by a strong rebound in biotech. HLB, the fifth-largest company on the index, jumped 13.68 percent to 53,600 won after announcing plans to issue 201 billion won ($140 million) in exchangeable bonds to U.K.-based hedge fund LMR Partners.

In Japan, the Nikkei 225 dropped 1.74 percent to 51,497.20, as investors locked in profits following the index’s run of record highs. AI-linked names led the pullback, with Advantest tumbling 5.86 percent to 21,780 yen ($141.8) and SoftBank Group sliding 7 percent to 25,160 yen.

Cable-related stocks in Tokyo mirrored Seoul’s strength, with Sumitomo Cable jumping 7.3 percent to 412 yen, lifted by Nadella’s comments on looming power-supply constraints.

Elsewhere in the region, China’s Shanghai Composite Index dipped 0.41 percent to 3,960.19 on persistent unease over U.S.–China trade tensions. Taiwan’s TAIEX lost 0.77 percent to 28,116.56, while Hong Kong’s Hang Seng Index fell 0.79 percent to 25,952.40.

Kim Yeon-jae Reporter duswogmlwo77@ajupress.com

![[포토] 예지원, 전통과 현대가 공존한 화보 공개](https://image.ajunews.com/content/image/2025/10/09/20251009182431778689.jpg)

![블랙핑크 제니, 최강매력! [포토]](https://file.sportsseoul.com/news/cms/2025/09/05/news-p.v1.20250905.ed1b2684d2d64e359332640e38dac841_P1.jpg)

![[포토] 발표하는 김정수 삼양식품 부회장](https://image.ajunews.com/content/image/2025/11/03/20251103114206916880.jpg)

![[포토]두산 안재석, 관중석 들썩이게 한 끝내기 2루타](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.1a1c4d0be7434f6b80434dced03368c0_P1.jpg)

![블랙핑크 제니, 매력이 넘쳐! [포토]](https://file.sportsseoul.com/news/cms/2025/09/05/news-p.v1.20250905.c5a971a36b494f9fb24aea8cccf6816f_P1.jpg)

![[포토] '삼양1963 런칭 쇼케이스'](https://image.ajunews.com/content/image/2025/11/03/20251103114008977281.jpg)

![[포토] 박지현 '순백의 여신'](http://www.segye.com/content/image/2025/09/05/20250905507414.jpg)

![[포토] 키스오브라이프 하늘 '완벽한 미모'](http://www.segye.com/content/image/2025/09/05/20250905504457.jpg)

![[포토] 아이들 소연 '매력적인 눈빛'](http://www.segye.com/content/image/2025/09/12/20250912508492.jpg)

![[포토] 국회 예결위 참석하는 김민석 총리](https://cphoto.asiae.co.kr/listimg_link.php?idx=2&no=2025110710410898931_1762479667.jpg)

![[포토] 박지현 '아름다운 미모'](http://www.segye.com/content/image/2025/11/19/20251119519369.jpg)

![[포토] 김고은 '단발 여신'](http://www.segye.com/content/image/2025/09/05/20250905507236.jpg)

![[작아진 호랑이③] 9위 추락 시 KBO 최초…승리의 여신 떠난 자리, KIA를 덮친 '우승 징크스'](http://www.sportsworldi.com/content/image/2025/09/04/20250904518238.jpg)

![[포토]첫 타석부터 안타 치는 LG 문성주](https://file.sportsseoul.com/news/cms/2025/09/02/news-p.v1.20250902.8962276ed11c468c90062ee85072fa38_P1.jpg)

![[포토] 알리익스프레스, 광군제 앞두고 팝업스토어 오픈](https://cphoto.asiae.co.kr/listimg_link.php?idx=2&no=2025110714160199219_1762492560.jpg)

![[포토] 키스오브라이프 쥴리 '단발 여신'](http://www.segye.com/content/image/2025/09/05/20250905504358.jpg)

![[포토]끝내기 안타의 기쁨을 만끽하는 두산 안재석](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.0df70b9fa54d4610990f1b34c08c6a63_P1.jpg)

![[포토] 한샘, '플래그십 부산센텀' 리뉴얼 오픈](https://image.ajunews.com/content/image/2025/10/31/20251031142544910604.jpg)

![[포토] 언론 현업단체, "시민피해구제 확대 찬성, 권력감시 약화 반대"](https://image.ajunews.com/content/image/2025/09/05/20250905123135571578.jpg)

![[포토] 김고은 '상연 생각에 눈물이 흘러'](http://www.segye.com/content/image/2025/09/05/20250905507613.jpg)

![[포토]두산 안재석, 연장 승부를 끝내는 2루타](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.b12bc405ed464d9db2c3d324c2491a1d_P1.jpg)

![[포토] 아홉 '신나는 컴백 무대'](http://www.segye.com/content/image/2025/11/04/20251104514134.jpg)

![[포토] TXT 범규 '반가운 손인사'](http://www.segye.com/content/image/2025/11/05/20251105518398.jpg)