Graphics by AJP Song Ji-yoon

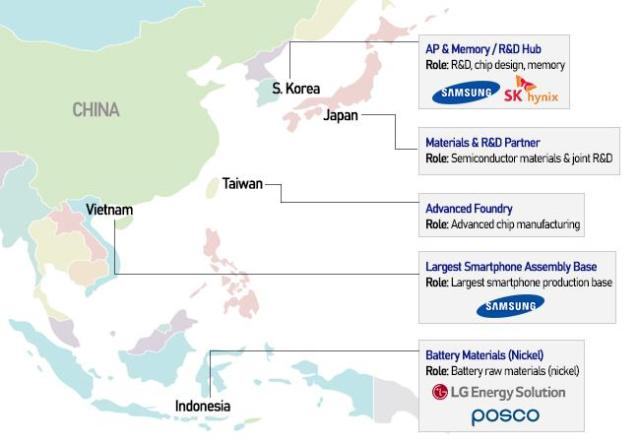

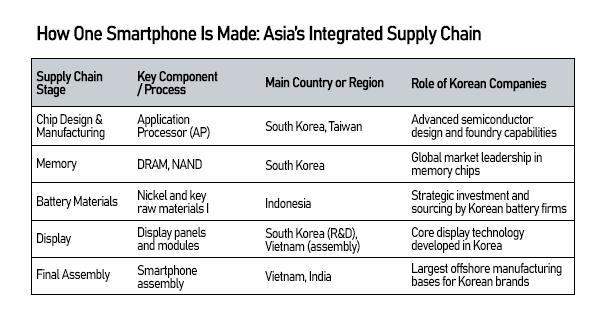

Graphics by AJP Song Ji-yoon SEOUL, December 01 (AJP) - A Samsung Galaxy phone can no longer be described as “made in Korea” in any literal sense. Battery materials mined in Indonesia, memory chips manufactured in Korea, components sourced from Japan and final assembly in Vietnam or India all feed into a device that takes weeks to complete and crosses multiple borders before reaching a consumer.

The smartphone illustrates how Samsung Electronics has secured its position at the premium end of the global market. Rather than relying on domestic production, the company has stitched together a regional value chain that balances cost pressures with technological quality — and reflects the increasingly interdependent nature of Asian manufacturing.

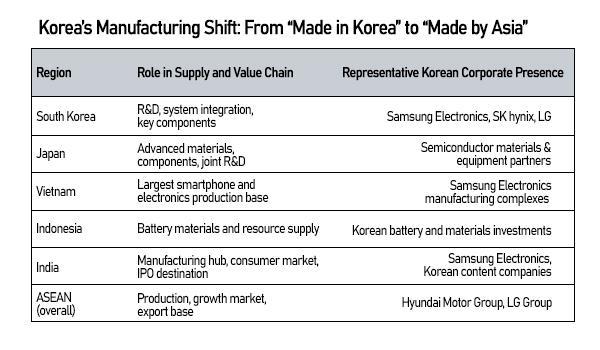

Korean companies, once squeezed by the swift ascent of China’s state-backed industries, have instead leaned into the strengths of neighboring economies. The result is not a retreat of Korean competitiveness but its reinvention through a wider Asian production system.

One smartphone, many countries: the reality of “Made by Asia”

In an era of geopolitical contest, the notion of a single “country of origin” has become increasingly anachronistic. It also explains why trade restrictions aimed at one country generate outsized uncertainty for global producers.

A high-end Korean smartphone today is a composite of the region’s industrial capacities. The application processor is developed through advanced foundries in Korea and Taiwan; memory is produced in Korean cleanrooms; Indonesia supplies key battery minerals; displays are engineered using Korean technology but assembled overseas; and the final product is put together largely in Vietnam and India.

Graphics by AJP Song Ji-yoon

Graphics by AJP Song Ji-yoon Samsung now manufactures roughly 80 per cent of its smartphones outside Korea, with Vietnam as its largest base and India expanding rapidly as a second hub.

Samsung Electronics’ manufacturing complex in Vietnam/ Courtesy of Samsung Electronics

Samsung Electronics’ manufacturing complex in Vietnam/ Courtesy of Samsung Electronics According to Kyung-hyun Koo, a researcher at the Korea Institute for International Economic Policy (KIEP), this overseas production structure has long been central to Korea’s industrial success.

“This is not a recent phenomenon but has been the core success formula of Korea’s key industries since the 2000s,” Koo said. “Korean firms have expanded production networks to overseas locations where low-cost manufacturing is possible, while focusing domestically on higher value-added processes. Given Korea’s limited resources and production capacity, building production partnerships abroad and making efficient use of global networks has been an inevitable and important strategy — and one that remains essential going forward.”

He added that heavy concentration in a single production base inevitably carries risks.

“It is difficult to quantify precisely, but if production in Vietnam were to be completely disrupted, the impact would be very significant,” Koo said. “From that perspective, excessive reliance on one country carries inherent risks, which is why continuously expanding and diversifying production networks is so important.”

No longer “Made in Korea”: TVs follow a similar trajectory

Korea’s television industry underscores the same shift.

Samsung and LG continue to dominate the upper tier of the global market, yet few of their high-end sets are produced onshore. Core display panel production has moved offshore, while assembly lines are concentrated in Vietnam, Mexico and elsewhere in Southeast Asia.

Koo said this should be understood as a structural reorganization rather than industrial decline.

“Without such a shift, it would be difficult to maintain price competitiveness,” he said. “The real challenge lies in how Korea continues to secure higher value-added processes domestically. The idea that everything must be produced in Korea belongs to the past, and building and effectively utilizing overseas production networks will remain a long-term task for Korean industries.”

Korea and Japan: from industrial rivals to research partners

Perhaps the sharpest illustration of Asia’s evolving industrial architecture lies in the changing relationship between Korea and Japan.

The two were once fierce competitors in semiconductors and displays. Today, their supply chains are increasingly intertwined. Japanese strengths in foundational materials and specialized components now complement Korea’s expertise in mass production, system integration and chip design.

Recent government-backed initiatives have accelerated joint work in next-generation semiconductors, AI-related technologies and advanced materials — areas both countries view as critical for maintaining technological relevance.

ASEAN and India: from low-cost bases to strategic pillars

Southeast Asia has moved well beyond its reputation as a low-cost manufacturing zone.

Vietnam alone accounts for an estimated 14 per cent of Korea’s total exports, thanks largely to Samsung’s vast operations. Indonesia, meanwhile, has become a crucial supplier of nickel and other battery minerals vital to Korea’s EV and energy-storage ambitions.

India is emerging as both an alternative production base to China and a major consumer market. Korean companies that once looked primarily to Nasdaq are now weighing Indian IPOs, while expanding their local footprints to tap long-term demographic and digital growth.

Graphics by AJP Song Ji-yoon

Graphics by AJP Song Ji-yoon Koo noted that ASEAN countries are also seeking to move beyond low value-added production.

“ASEAN economies are themselves recognizing the limits of remaining in low value-added manufacturing and are aiming to upgrade,” he said. “There are areas where the needs of both sides align, even as challenges related to workforce skills and industrial infrastructure remain.”

On India, he added, “many major Korean companies now view India as one of their most promising export markets going forward,” Koo said. “Given its large population and stage of industrial development, it is a market Korea cannot afford to overlook, even though challenges remain.”

Hyundai Motor India marked its public market debut in India on Oct.22, 2024/ Courtesy of Hyundai Motor Group

Hyundai Motor India marked its public market debut in India on Oct.22, 2024/ Courtesy of Hyundai Motor Group Asia as a coherent production bloc, not fragmented economies

With the US and China erecting new barriers across trade and technology, Korea’s competitiveness increasingly depends on the strength of its regional partnerships. What is emerging is not a set of isolated players but an integrated Asian production bloc — one in which supply chains, investment flows and technological capabilities reinforce one another.

“Made in Korea” has become less a territorial label than a shorthand for an industrial ecosystem rooted in Asia’s collective strength.

“As Asia’s overall economic value increases, the roles played by different parts of the region are also expected to grow,” Koo said. “What matters most going forward is a strategic approach in which each country identifies areas of comparative advantage, focuses its investments accordingly and builds long-term partnerships rather than seeking quick gains.”

Candice Kim 기자 candicekim1121@ajupress.com

![[포토] 예지원, 전통과 현대가 공존한 화보 공개](https://image.ajunews.com/content/image/2025/10/09/20251009182431778689.jpg)

![블랙핑크 제니, 최강매력! [포토]](https://file.sportsseoul.com/news/cms/2025/09/05/news-p.v1.20250905.ed1b2684d2d64e359332640e38dac841_P1.jpg)

![[포토] 발표하는 김정수 삼양식품 부회장](https://image.ajunews.com/content/image/2025/11/03/20251103114206916880.jpg)

![[포토]두산 안재석, 관중석 들썩이게 한 끝내기 2루타](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.1a1c4d0be7434f6b80434dced03368c0_P1.jpg)

![블랙핑크 제니, 매력이 넘쳐! [포토]](https://file.sportsseoul.com/news/cms/2025/09/05/news-p.v1.20250905.c5a971a36b494f9fb24aea8cccf6816f_P1.jpg)

![[포토] '삼양1963 런칭 쇼케이스'](https://image.ajunews.com/content/image/2025/11/03/20251103114008977281.jpg)

![[포토] 박지현 '순백의 여신'](http://www.segye.com/content/image/2025/09/05/20250905507414.jpg)

![[포토] 키스오브라이프 하늘 '완벽한 미모'](http://www.segye.com/content/image/2025/09/05/20250905504457.jpg)

![[포토] 아이들 소연 '매력적인 눈빛'](http://www.segye.com/content/image/2025/09/12/20250912508492.jpg)

![[포토] 국회 예결위 참석하는 김민석 총리](https://cphoto.asiae.co.kr/listimg_link.php?idx=2&no=2025110710410898931_1762479667.jpg)

![[포토] 박지현 '아름다운 미모'](http://www.segye.com/content/image/2025/11/19/20251119519369.jpg)

![[포토] 김고은 '단발 여신'](http://www.segye.com/content/image/2025/09/05/20250905507236.jpg)

![[작아진 호랑이③] 9위 추락 시 KBO 최초…승리의 여신 떠난 자리, KIA를 덮친 '우승 징크스'](http://www.sportsworldi.com/content/image/2025/09/04/20250904518238.jpg)

![[포토]첫 타석부터 안타 치는 LG 문성주](https://file.sportsseoul.com/news/cms/2025/09/02/news-p.v1.20250902.8962276ed11c468c90062ee85072fa38_P1.jpg)

![[포토] 알리익스프레스, 광군제 앞두고 팝업스토어 오픈](https://cphoto.asiae.co.kr/listimg_link.php?idx=2&no=2025110714160199219_1762492560.jpg)

![[포토] 키스오브라이프 쥴리 '단발 여신'](http://www.segye.com/content/image/2025/09/05/20250905504358.jpg)

![[포토]끝내기 안타의 기쁨을 만끽하는 두산 안재석](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.0df70b9fa54d4610990f1b34c08c6a63_P1.jpg)

![[포토] 한샘, '플래그십 부산센텀' 리뉴얼 오픈](https://image.ajunews.com/content/image/2025/10/31/20251031142544910604.jpg)

![[포토] 언론 현업단체, "시민피해구제 확대 찬성, 권력감시 약화 반대"](https://image.ajunews.com/content/image/2025/09/05/20250905123135571578.jpg)

![[포토] 김고은 '상연 생각에 눈물이 흘러'](http://www.segye.com/content/image/2025/09/05/20250905507613.jpg)

![[포토]두산 안재석, 연장 승부를 끝내는 2루타](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.b12bc405ed464d9db2c3d324c2491a1d_P1.jpg)

![[포토] 아홉 '신나는 컴백 무대'](http://www.segye.com/content/image/2025/11/04/20251104514134.jpg)

![[포토] TXT 범규 '반가운 손인사'](http://www.segye.com/content/image/2025/11/05/20251105518398.jpg)