Graphics by AJP Song Ji-yoon

Graphics by AJP Song Ji-yoon SEOUL, January 14 (AJP) - Over the past year, South Korea’s memory chipmaker SK hynix has nearly quadrupled its market value and overtaken Intel in sales to become the world’s third-largest semiconductor company after behind Nvidia and Samsung Electronics.

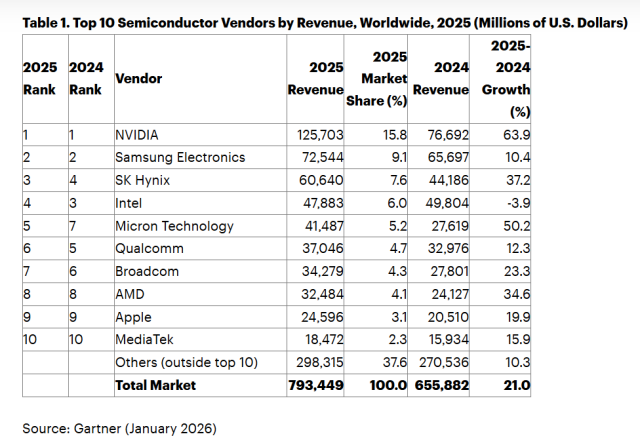

The turning point came in 2025, a decisive year for the AI-driven chip upcycle. Global semiconductor sales jumped 21 percent to $793 billion, led by AI processors, high-bandwidth memory (HBM) and networking chips, according to preliminary data released by Gartner on Tuesday.

“AI semiconductors — including processors, high-bandwidth memory and networking components — continued to drive unprecedented growth in the semiconductor market, accounting for nearly one-third of total sales in 2025,” said Rajeev Rajput, senior principal analyst at Gartner.

The momentum is set to intensify. “AI infrastructure spending is forecast to surpass $1.3 trillion in 2026,” he added.

Courtesy of Gartner

Courtesy of Gartner HBM propels SK hynix past Intel

SK hynix climbed to third place as its global revenue surged 37 percent on year to about $61 billion in 2025, powered by explosive demand for HBM used in Nvidia’s AI accelerators. Intel slipped to fourth, with its market share falling to around 6 percent — roughly half the level it commanded in 2021.

Kim Duk-ki, a professor of semiconductor systems engineering at Sejong University, said Intel’s long-standing dominance has steadily eroded.

“Intel once sat firmly on the throne, but its competitiveness has weakened in recent years,” Kim said. “Even with strong backing from the U.S. government and renewed efforts to rebuild its foundry business, its long-term direction remains uncertain.”

By contrast, he said, SK hynix’s rise reflects more than a cyclical rebound.

“Given the structural shift driven by AI, this should not be viewed as a temporary phenomenon,” Kim said. “The gap between SK hynix and Intel could persist for some time.”

From memory supplier to “full-stack AI” player

To cement its lead, SK hynix has decided to invest 19 trillion won ($14 billion) to build an advanced AI memory packaging plant in Cheongju, North Chungcheong Province.

HBM lies at the heart of the strategy. The technology stacks multiple DRAM layers and integrates them with graphics processing units (GPUs) into a single package. Taiwan Semiconductor Manufacturing Co. (TSMC) currently leads advanced packaging, combining SK hynix’s HBM with Nvidia GPUs using its proprietary Chip-on-Wafer-on-Substrate (CoWoS) process — now a standard for high-end AI chips.

SK hynix’s decision to build large-scale packaging facilities is widely seen as an attempt to move beyond the role of a component supplier and realize its vision of becoming a “full-stack AI memory creator.”

Its local competitor Samsung Electronics has been pitching its turnkey solution that combines foundry manufacturing, HBM supply and advanced packaging under one roof.

The investment is also set to elevate the strategic value of SK hynix’s Cheongju campus as an AI semiconductor production hub. The site already hosts NAND fabs M11, M12 and M15, as well as the P&T3 facility handling back-end processes.

To secure next-generation DRAM capacity, SK hynix has committed nearly 20 trillion won to its M15X fab. Originally scheduled for later completion, the facility opened its cleanroom last October and is now installing equipment, with mass production expected to begin as early as the second half of this year.

Talent war intensifies

As SK hynix climbs the global rankings, it is also investing heavily to secure future growth by retaining and attracting talent.

The AI-driven memory supercycle has translated into record performance bonuses, intensifying competition across South Korea’s semiconductor industry. SK hynix recently revamped its profit-sharing system, linking employee bonuses more directly to operating profit and removing caps that previously limited payouts.

Industry estimates suggest that if current earnings momentum holds, average bonuses could exceed 100 million won ($75,000) per employee this year, with some projections pointing even higher next year if profits continue to surge.

The widening compensation gap is already being felt at rival Samsung Electronics, where employees in the memory division have raised concerns over disparities in rewards despite sharing in the same industry upcycle. The issue has added to labor tensions and renewed calls for changes to performance-based pay structures.

The effects are visible upstream as well. Competition ratios for semiconductor majors at universities with recruitment agreements with SK hynix — including Hanyang, Chung-Ang, Sogang and Korea University — have climbed to between 9:1 and 11.8:1, sharply above the average 5.31:1 ratio across 11 elite Seoul-based universities.

With AI processors generating more than $200 billion in sales last year and HBM accounting for nearly a quarter of the global DRAM market, Gartner forecasts that AI-related chips could represent more than half of total semiconductor revenue by 2029.

SK hynix’s HBM3E high-bandwidth memory is displayed at CES 2026, Las Vegas/ Yonhap

SK hynix’s HBM3E high-bandwidth memory is displayed at CES 2026, Las Vegas/ Yonhap Candice Kim 기자 candicekim1121@ajupress.com

![[포토] 폭설에 밤 늦게까지 도로 마비](https://image.ajunews.com/content/image/2025/12/05/20251205000920610800.jpg)

![[포토] 국회 예결위 참석하는 김민석 총리](https://cphoto.asiae.co.kr/listimg_link.php?idx=2&no=2025110710410898931_1762479667.jpg)

![[포토] 예지원, 전통과 현대가 공존한 화보 공개](https://image.ajunews.com/content/image/2025/10/09/20251009182431778689.jpg)

![[포토] 알리익스프레스, 광군제 앞두고 팝업스토어 오픈](https://cphoto.asiae.co.kr/listimg_link.php?idx=2&no=2025110714160199219_1762492560.jpg)

![[포토]두산 안재석, 관중석 들썩이게 한 끝내기 2루타](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.1a1c4d0be7434f6b80434dced03368c0_P1.jpg)

![[작아진 호랑이③] 9위 추락 시 KBO 최초…승리의 여신 떠난 자리, KIA를 덮친 '우승 징크스'](http://www.sportsworldi.com/content/image/2025/09/04/20250904518238.jpg)

![블랙핑크 제니, 최강매력! [포토]](https://file.sportsseoul.com/news/cms/2025/09/05/news-p.v1.20250905.ed1b2684d2d64e359332640e38dac841_P1.jpg)

![[포토]첫 타석부터 안타 치는 LG 문성주](https://file.sportsseoul.com/news/cms/2025/09/02/news-p.v1.20250902.8962276ed11c468c90062ee85072fa38_P1.jpg)

![[포토] 아홉 '신나는 컴백 무대'](http://www.segye.com/content/image/2025/11/04/20251104514134.jpg)

![블랙핑크 제니, 매력이 넘쳐! [포토]](https://file.sportsseoul.com/news/cms/2025/09/05/news-p.v1.20250905.c5a971a36b494f9fb24aea8cccf6816f_P1.jpg)

![[포토] 박지현 '아름다운 미모'](http://www.segye.com/content/image/2025/11/19/20251119519369.jpg)

![[포토] 키스오브라이프 하늘 '완벽한 미모'](http://www.segye.com/content/image/2025/09/05/20250905504457.jpg)

![[포토] 박지현 '순백의 여신'](http://www.segye.com/content/image/2025/09/05/20250905507414.jpg)

![[포토] 김고은 '단발 여신'](http://www.segye.com/content/image/2025/09/05/20250905507236.jpg)

![[포토] 발표하는 김정수 삼양식품 부회장](https://image.ajunews.com/content/image/2025/11/03/20251103114206916880.jpg)

![[포토] 언론 현업단체, "시민피해구제 확대 찬성, 권력감시 약화 반대"](https://image.ajunews.com/content/image/2025/09/05/20250905123135571578.jpg)

![[포토] '삼양1963 런칭 쇼케이스'](https://image.ajunews.com/content/image/2025/11/03/20251103114008977281.jpg)

![[포토] 한샘, '플래그십 부산센텀' 리뉴얼 오픈](https://image.ajunews.com/content/image/2025/10/31/20251031142544910604.jpg)

![[포토]끝내기 안타의 기쁨을 만끽하는 두산 안재석](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.0df70b9fa54d4610990f1b34c08c6a63_P1.jpg)

![[포토] 김고은 '상연 생각에 눈물이 흘러'](http://www.segye.com/content/image/2025/09/05/20250905507613.jpg)

![[포토] 아이들 소연 '매력적인 눈빛'](http://www.segye.com/content/image/2025/09/12/20250912508492.jpg)

![[포토]두산 안재석, 연장 승부를 끝내는 2루타](https://file.sportsseoul.com/news/cms/2025/08/28/news-p.v1.20250828.b12bc405ed464d9db2c3d324c2491a1d_P1.jpg)

![[포토] 키스오브라이프 쥴리 '단발 여신'](http://www.segye.com/content/image/2025/09/05/20250905504358.jpg)